10 Key Risks for Businesses in a Global Economy

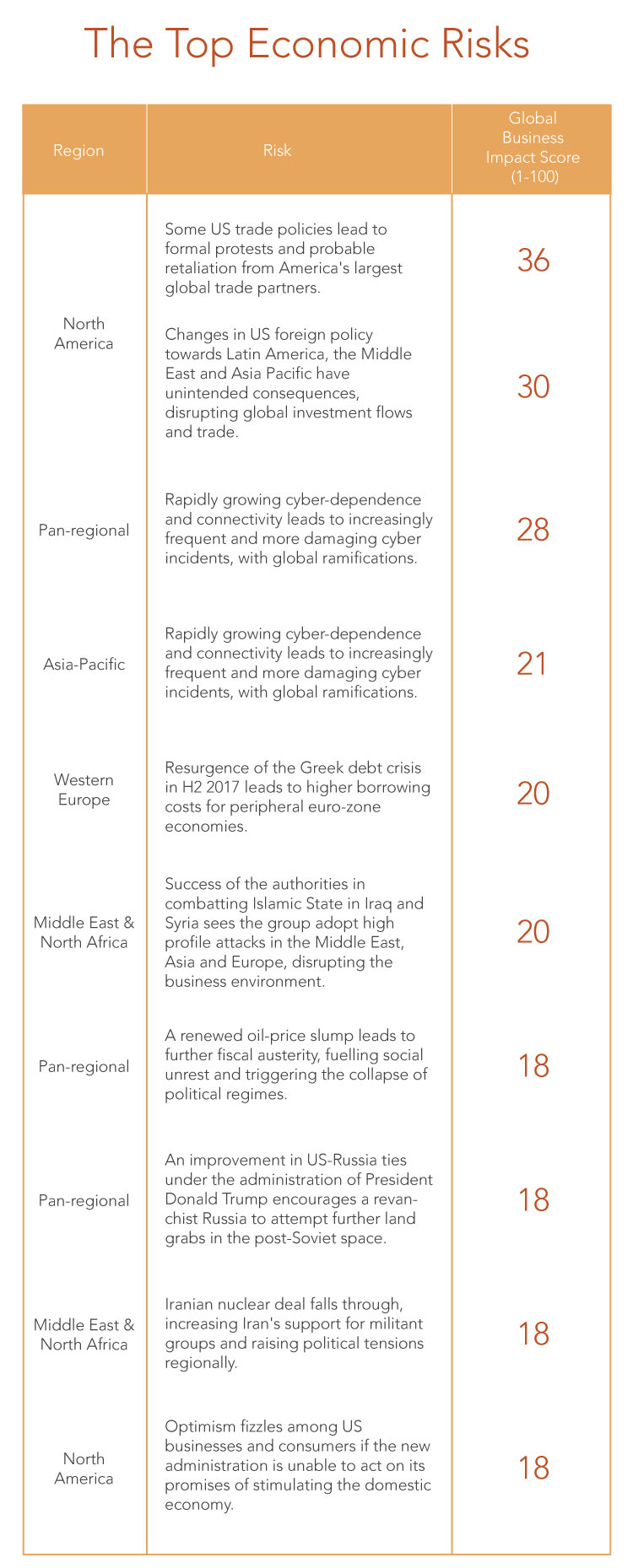

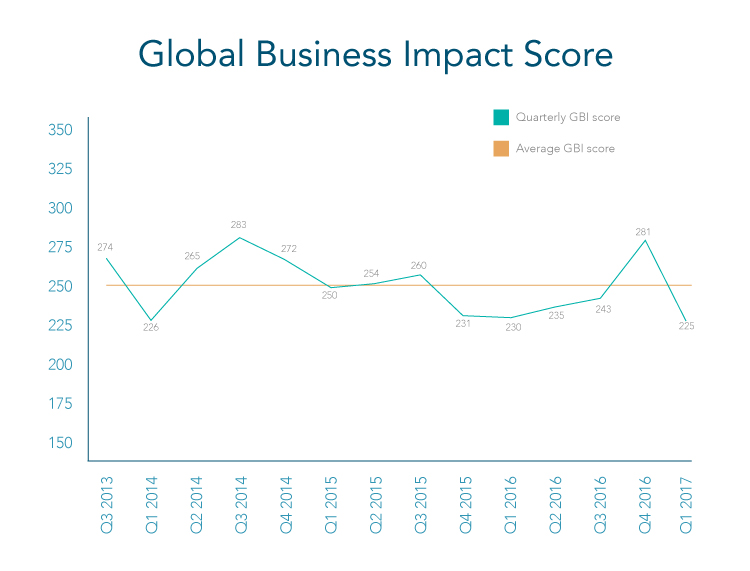

The Dun & Bradstreet Global Risk Matrix ranks the biggest threats to business based on each risk scenario’s potential impact on companies, assigning a score to each risk. The scores from the top ten risks are used to calculate an overall Global Business Impact score. Our latest Global Business Impact score highlights a significantly improved risk outlook for cross-border businesses: after last quarter’s near-record high, the score has now fallen to its lowest-ever level.

Risks At Their Lowest Since Global Risk Matrix Launched in 2013

Dun & Bradstreet’s Global Business Impact (GBI) score for Q1 2017 fell significantly to 227 (out of a maximum of 1,000) from the almost record high of 281 in Q4 2016. The Q1 figure is the lowest on record, and well below the long-term average of 252.1, and the average for 2016 of 247.25. The latest score confirms our view that business conditions, although still feeling the after-effects of the global financial crisis, have been able to cope with uncertainty caused by the unexpectedly dramatic political events in 2016 such as the vote in the UK to leave the EU and the election of Donald Trump as US president. These two events dominated the previous GRM. Nevertheless, business conditions are still more challenging than they were before the global financial crisis.

Our top ten risks combine an assessment of: (i) the magnitude of the event’s probable effect on the global business operating environment, on a scale of 1 to 5 (where 1 is the smallest impact and 5 is the largest); and (ii) the likelihood of the event happening.

Six New Risks in the Global Top 10

The Q1 2017 Global Risk Matrix has six new entries – of which four are related to the new administration in the US – highlighting the fact that finance, procurement and supply chain teams across all business sectors face urgent and ever-evolving risks in an increasingly complex and globalised world. The six new-entry risks are:

- Disagreement with some aspects of US trade policies leads to formal protests and probable retaliation from America's largest global trade partners (GBI 36, out of a maximum 100);

- Rapidly growing cyber-dependence and connectivity leads to increasingly frequent and more damaging cyber incidents, with global ramifications (GBI of 28);

- Resurgence of the Greek debt crisis in H2 2017, leads to higher borrowing costs for peripheral euro-zone economies (20);

- A renewed oil-price slump leads to further fiscal austerity, fuelling social unrest and triggering the collapse of political regimes (18);

- An improvement in US-Russia ties under the administration of President Donald Trump encourages a revanchist Russia to attempt further land grabs in the post-Soviet space (18); and

- Optimism fizzles among US businesses and consumers if the new administration is unable to act on its promises of stimulating the domestic economy (16).

Among our pre-existing risks, we have decreased the likelihood (from 50% to 35%) of contagion from bad debts in Chinese industry and local government triggering a hard landing for GDP and state rescues of mid-tier banks; this has resulted in the GBI decreasing from 28 to 21. In addition, we increased the likelihood (from 15% to 45%) of the Iranian nuclear deal falling through, thereby increasing Tehran’s support for militant groups and raising political tensions regionally, resulting in the GBI increasing from 12 to 18. The remaining two risks saw no change in their GBI scores from Q4 2016.

Political Risks Top Global Risk Matrix

The top two risks in our GRM emanate from North America and in particular the potential ramifications of policies being adopted by the new US administration. In first place is our fear of a global trade war as some of the policies adopted by the Trump administration might lead to formal protests and probable retaliation from America's largest global trade partners. This would curtail further (already weak) global trade and investment growth, undermining the global economic recovery. We have assessed the GBI score at 36 (out of a maximum 100).

Relatedly, in second place with a GBI of 30 is the risk associated with the new administration’s foreign policy, particularly in relation to Mexico, Venezuela, the war-torn countries of the Middle East, and China. These could have unintended consequences leading to domestic instability in the countries concerned and/or wider regional problems. Also related to Trump’s foreign policy is an improvement in US-Russia ties, which could encourage a revanchist Russia to attempt further land grabs in the post-Soviet space. We have assigned a likelihood of 30% to this event and a GBI of 18, ranking it at equal seventh. Also at equal seventh, we have increased the likelihood of the Iranian nuclear deal falling through because of American antipathy to the regime in Tehran. This would greatly increase the likelihood of Tehran’s support for militant groups in the MENA region being ratcheted up, potentially undermining global oil supplies.

Another risk related to the new US government is that the initial market enthusiasm for Trump’s policies fizzles if the new administration is unable to deliver on its promises of stimulating the domestic economy. We have assigned a likelihood of 40% to this, a global impact of 2 (out of 5) and a consequent GBI of 16 and a ranking of 10.

The final political event that we highlight, with a GBI of 20 in equal fifth place, is the risk associated with the military success in combatting Islamic State in Iraq, Syria and Libya. Our concern here is that this will result in the group undertaking high-profile attacks in the Middle East, Europe and Asia in order to offset the setbacks. This could disrupt the business environment in the three regions.

Economic Concerns in the Global Risk Matrix

We have two debt-related risks in our top ten. In fourth place, with a GBI of 21, down from 30 in the previous report, is the threat of possible default contagion in China. Should this happen it would trigger additional problems in the financial sector, necessitating state rescues and emergency capital issues, particularly for mid-tier banks. Among the upstream industries that currently appear to have too much capacity are steel-making, ship-building, solar panels, coal, property and local government (and possibly cement, glass-making, aluminium and commercial real estate in the Yangtze River delta). A systemic collapse in the Chinese financial sector would curtail cross-border trade and investment opportunities.

The second debt risk, in equal fifth place, is the reappearance of the Greek debt crisis in H2 2017, leading to higher borrowing costs for peripheral euro-zone countries and a consequent slowdown in their economies. We have assigned a likelihood of 50% and a GBI of 20.

In equal seventh place, with a GBI of 18, is the final pan-regional economic risk in our top ten. This is our fear that a renewed oil-price slump leads to further fiscal austerity, fuelling social unrest and triggering the collapse of political regimes, particularly in Central Asia, the Middle East and Africa.

Commercial Concerns in the Global Risk Matrix

In third place with a GBI of 28 (no change) is the foremost pan-regional risk. Rapidly growing cyber-dependence and connectivity could lead to increasingly frequent and more damaging cyber-attacks, with ramifications for doing business.

Summary: Business Environment Improves, Yet Remains Challenging

The Dun & Bradstreet Global Business Impact score for Q1 2017 highlights that risks facing businesses have fallen in the quarter, and are now at their lowest level since the GRM started. This indicates that businesses have overcome the high levels of uncertainty caused by the Brexit and Trump votes in 2016. Nevertheless, the business environment remains challenging, and business decision-makers need to be aware of the rapidly-changing risk environment.