This is the first in a series of Perspective articles giving insights you can use on your account based marketing programs.

Account based marketing (ABM) hinges on sales and marketing identifying and aligning on the accounts and contacts to pursue, and then engaging those accounts with relevant and personalized messages and offers. Needless to say, segmentation is the cornerstone for driving ABM engagement.

There are different types of segmentation you need to do to achieve this. Are you trying to target net new prospect accounts or customers? What about early stage, “non-engaged” prospects, or prospects with open late-stage opportunities? Do you have cold “zombie prospects” in your database? As a marketer, there are many ways to “skin this cat” as it were.

In this post, I will give a behind the scenes look at how we think about ABM segmentation at Dun & Bradstreet so that marketing and sales are able to drive maximum engagement and deliver on pipeline and revenue objectives. This methodology has enabled us to increase our engagement within target accounts for our B2B Customer Data Platform (CDP) by more than 80%.

Four Steps to ABM Segmentation

Figure 1: Four steps of our ABM segmentation strategy

Since we’re trying to optimize the engagement with our target accounts, our segmentation is focused on determining who are our highest value targets and where they are in their buyer journey.

We use four key steps in our segmentation.

1. It starts with defining our target account universe for the solution.

Since D&B Lattice is a B2B Customer Data Platform, we have a large target: practically any business with a sales and marketing team. Given our strategic priorities and focus, we determined a target universe of about 10,000 companies.

2. We determine level-of-fit for each target.

We’ve developed an Ideal Customer Profile (ICP) for the solution and use predictive account scoring to assess target accounts that are “high fit” (the “A” and “B” accounts) and which are “low fit” (the “C” and “D” accounts). The ICP and associated scores enable sales and marketing to be aligned on who to target and how to prioritize joint efforts to drive engagement with the targets.

3. We map each target to the appropriate stage in the buyer journey.

By using a combination of first- and third-party intent data, we can tell where each of our target accounts is in their buyer journey:

- Not-in-market: they’re not actively researching or searching for a solution

- In-market: they’re actively researching for potential solutions online on third-party websites and forums

- Anonymously engaged: they’re visiting our website and engaging with our content but anonymously

- Opted-in: they have provided us with permission to email them in exchange for downloading a piece of content or joining a webinar

- Hand raiser: they’ve submitted the “Contact Us” form and have asked for us to reach out (this stage also includes targets with active opportunities – we didn’t break this out for simplicity)

4. We layer in other key attributes to further personalize the message based on interest and profile.

Technographic data, online presence data, search, and ad investment data all provide additional data points we use to create more relevant messages and offers. For instance, most of our customers already have some sort of marketing automation platform in place. For example, if a target is a Marketo customer, we’ll show a case study of another Marketo customer (ideally in the same industry and solving the same problem).

Achieving Relevance and Focus

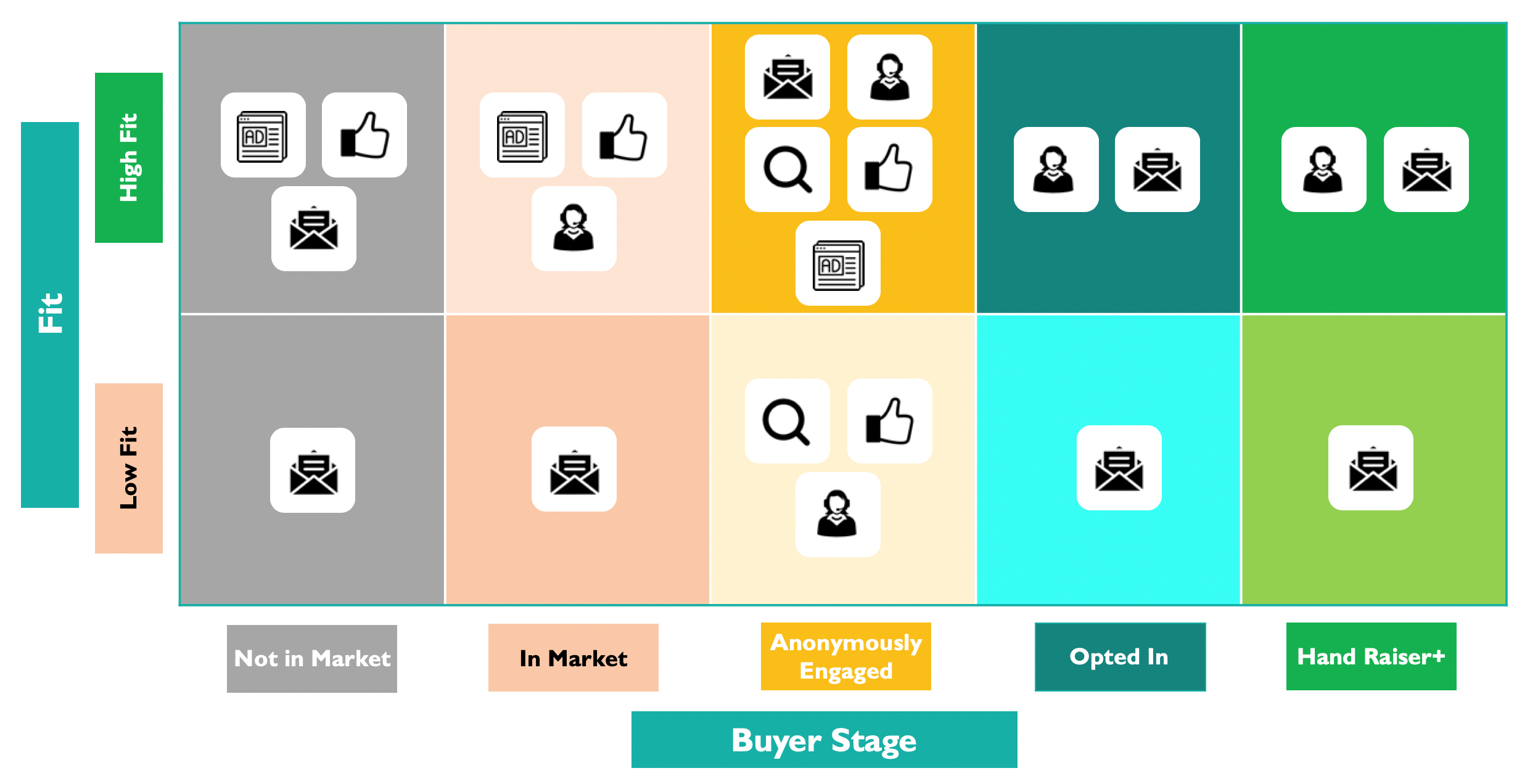

Figure 2: Our Segmentation strategy is to identify our high value targets and assess their place in the buyer journey

This segmentation strategy for our CDP opportunities enables us to achieve two things: relevance and focus.

First, we can engage with messaging and offers that are properly matched to each buyer’s place in their buyer’s journey.

For instance, if someone is in the “in-market” stage they likely have an active project in place, so we try to activate their interest in our brand with top of funnel messaging. This may be an analyst report outlining key criteria to consider when evaluating Customer Data Platform vendors.

In contrast, if someone is “anonymously engaged,” we’ll go more mid-funnel, based on their browsing history on our website, with offers to attend a demo webinar or a customer webinar, at which time we will ask for their opt-in to receive future communications.

We also layer in other attributes about each of our targets so that we can personalize messaging on more than just buyer stage, for example, what kind of marketing automation system they have. We generally sell to companies that have deployed marketing automation systems such as Marketo, Eloqua, and HubSpot.

Second, we can make smarter decisions around which channels and tactics to use and how much to invest. Here’s where the “high fit” versus “low fit” comes into play.

For instance, rather than taking a “spray-and-pray” approach with our retargeting budget on anyone who visits our website, we will put more budget on those anonymous visitors from high-fit accounts than those from low-fit accounts.

The other factor that comes into play here is exactly how engaged the buyer is at each stage of the buyer journey. For instance, if we see that a high-fit target is expressing very high intent (i.e. they’ve been recognized as being in-market for a few weeks and have been trending high by researching multiple keywords) we will also alert our Sales Development Representatives so they can prioritize outreach appropriately.

Room for Improvement

While this segmentation strategy has yielded significant positive results for us, there’s always room for improvement. First, we can (and will) also layer in product usage data to help drive cross-sell / up-sell programs in addition to new customer acquisition programs. (Several of our customers do this today.)

Second, we’re starting to experiment with the notion of identifying when buying groups are forming. As with all enterprise software providers, we sell to buying committees rather than just individuals. This means we are looking to layer in whether multiple people from the same target account are visiting our website (anonymously or otherwise) in the last two weeks, four weeks, etc.

Finally, there are opportunities to double-click on the “hand raiser” stage so that we can create programs that accelerate conversion.