The Efficiency Imperative for Finance and Credit Teams

Modern businesses are looking to finance teams to make sense of their data to drive growth and innovation. Automation is rapidly becoming a lynchpin for improving business performance in finance, where reducing cost and managing risk come with high expectations. Successful automation efforts will allow finance departments to add value in their roles, unleashing the potential to spend less time on administrative tasks and more time on strategy. Simply put, finance teams will fall behind if they do not embrace automation.

Dun & Bradstreet commissioned a survey of finance and credit leaders in the UK and the US in partnership with the Credit Research Foundation and the Chartered Institute of Credit Management in May 2019 to understand how their organizations are using automation today, and what the opportunities and barriers are.

Dun & Bradstreet’s new study found that 87% of surveyed finance leaders believe automation will improve the function’s efficiency in the next three years, giving employees more time for value-added tasks. But, most organizations aren’t leveraging automation to the fullest today. While 83% of finance teams are automating at least one part of their processes, most (62%) are automating less than one-fourth of their process.

Automation Transformation Report Findings

Reliable Data & Integration Are Essential to Finance Automation

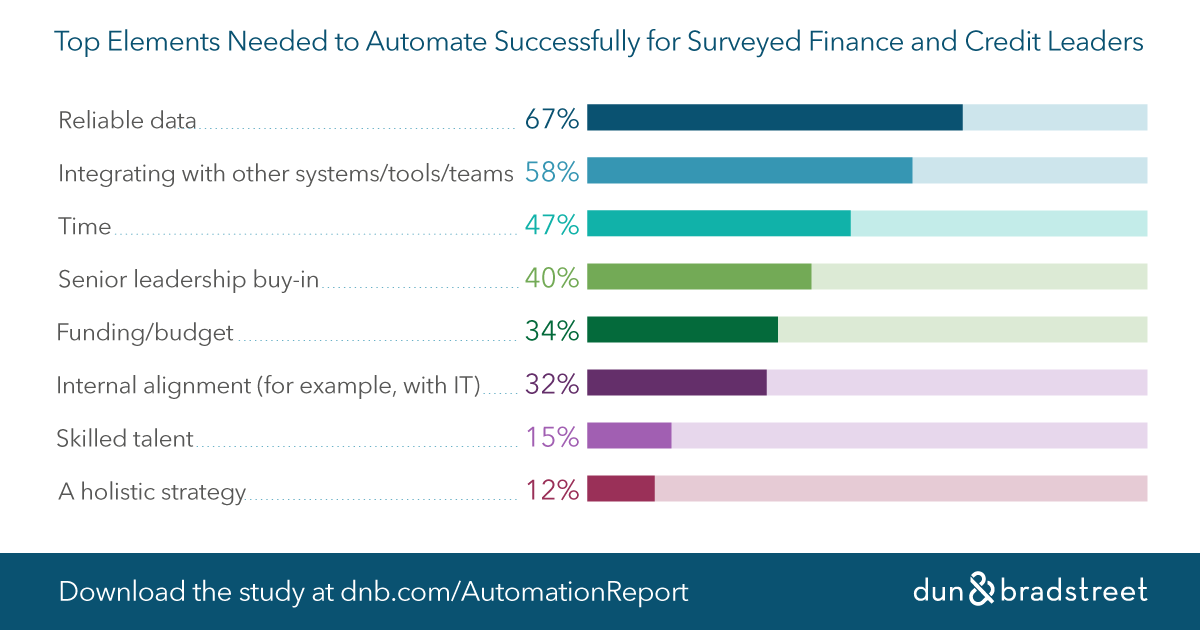

Reliable data is the top success factor of automation efforts, with over 67% of respondents citing this as a top need. Integration with other systems (58%) and time (47%) were also listed as top success factors.

The biggest barriers to automation are integrating multiple systems and tools (32%), funding and budget (26%) and managing disparate data (15%).

Operational Efficiency Is a Key Driver of Automation Efforts in Finance

Improved speed of processes is the top force driving the need to automate, according to 68% of respondents. This is followed by cost savings (55%).

Most Finance and Credit Teams Are Automating, but Vast Potential Remains

While 83% of finance teams are automating at least one part of their processes, most (62%) are only automating between 0-25% of their processes. One in five respondents reported that between 26 to 50% of their finance and credit process are automated today. Only 11% reported that more than half of their processes are automated.

When fueled by analytics and insight, automation can reduce operational costs, increase efficiency, and help open new avenues of growth for finance teams by scaling and pulling in data from multiple sources at once. Organizations driven by data and insights are 39% more likely to report year-over-year revenue growth of 15% or more. For finance leaders in particular, automation must go beyond a “good idea” and become a strategic methodology to ignite the true potential of human, data, and machine.

Methodology

In May 2019, Dun & Bradstreet collected approximately 250 responses via an online survey about automation trends from finance and credit leaders globally. Response sources included credit management institutions such as the Credit Research Foundation, the Chartered Institute of Credit Management, and from attendees of the National Association of Credit Managers Congress in May 2019, as well as Dun & Bradstreet’s own customers.

Download the study, “The Automation Transformation in Finance,” to learn more about some of the challenges and opportunities presented by automation for finance and credit teams.