Dun & Bradstreet manages the largest B2B commercial database in the world. At the core of this data is a proprietary trade program composed of many thousands of participants that collect detailed payment (invoice) information on millions of companies worldwide. The information collected allows Dun & Bradstreet to define and better understand how companies pay each other, to better understand supply chain networks, and to better understand what factors are significant in determining credit risk and growth opportunities. This trade program information is processed and used in many Dun & Bradstreet credit scores, models, and data elements.

By some estimates, trade credit accounts for approximately 15% to 20% of total assets and about 44% of total liabilities in the US. Given its massive size, economic significance, and high turnover, it should not come as a surprise that, depending on how it’s used, trade credit can have a dramatic influence on corporate growth and stock performance.

The Influence of Trade Credit on Corporate Growth and Stock Performance

Dun & Bradstreet’s Advanced Analytics team explored this influence in the study, “Payment Power and the Cross Section of Stock Returns: Does it Pay to Pay Consistently Late?”

- After controlling for other effects, the study finds that firms that pay their suppliers consistently late are rewarded with higher stock returns while firms that pay their suppliers inconsistently early are punished with lower stock returns. We find this effect persistent across time, across size, across weighting schemes and across sectors.

- To capture this exposure, the team created two new standardized scores: ISS_PAYNORM and ISS_PAYDEX in order to rank stocks. For ISS_PAYNORM, stocks that rank in the top decile outperform stocks that rank in the bottom decile by close to 9% per year over the last 12 years.

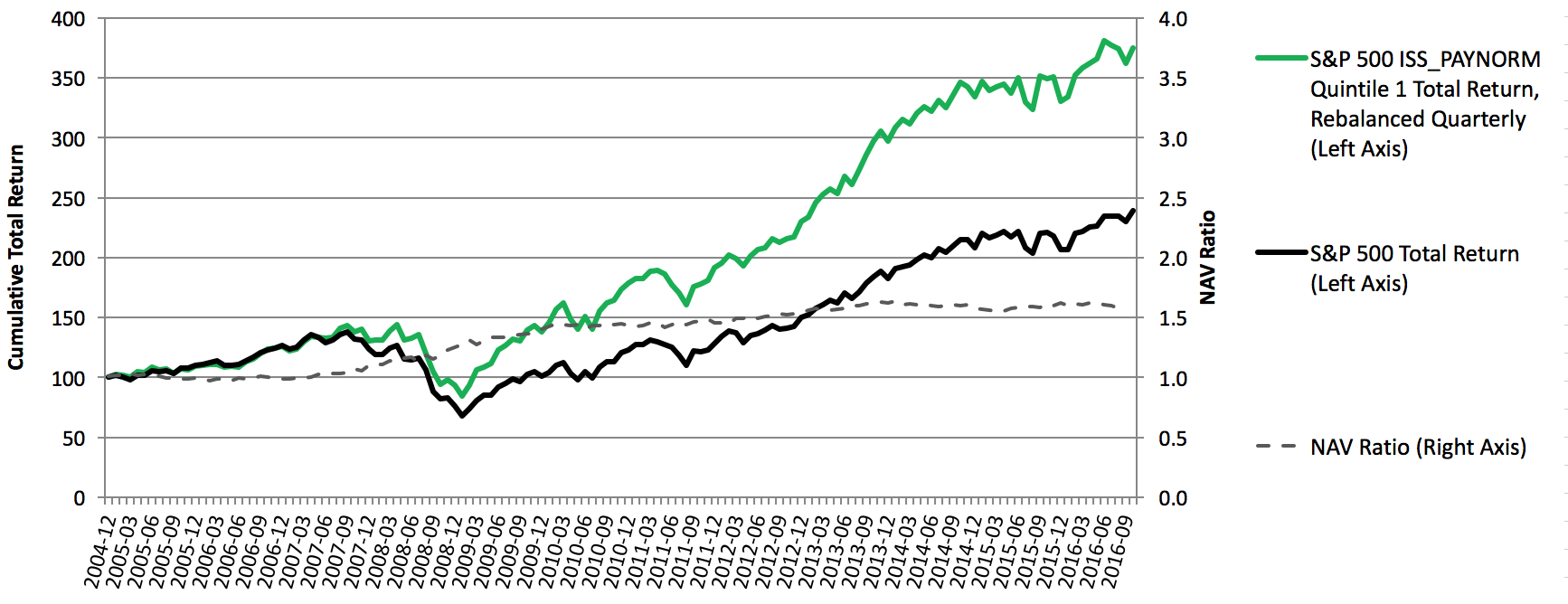

- Using S&P 500 stocks and weights, the graph below shows the cumulative total return of the top quintile ISS_PAYNORM portfolio (a long-only strategy), rebalanced quarterly versus the S&P 500 Index. This strategy outperforms the S&P 500 by 3.91% per year with a lower market beta and a higher return per unit of risk.

- The stock outperformance of consistent late payers suggests that suppliers provide key insight into the growth prospects of their buyers that investment managers can’t harness from elsewhere.

- However, large firms that have the market power to pay consistently later without penalty or loss of suppliers will benefit by: 1) increasing cash flow, 2) avoiding short-term financing to meet payables, 3) investing the extra cash, and 4) increasing their bargaining power over suppliers on price and volume.

In prior research, similar results were found for corporate bond credit spreads. This current study highlights recent academic studies and provides a thorough overview of Dun & Bradstreet’s own payment scoring methods.