A Guide to Implementing Automated Credit Decisioning Strategies

A typical business credit assessment can be broken down into three steps: identity resolution and verification, decisioning (whether to approve or decline the credit request), and credit limit assignment. Our clients have seen that third-party data is integral to making a truly informed credit assessment (and we hope you do too.)

Automation helps to streamline credit assessments and has many potential benefits: cost savings; more consistent, faster decisions; and ultimately, a better client experience. If you’re curious about how to get started, read on.

Identity Resolution and Verification

As the first step in the decisioning process, verifying the applicant’s identity is critical to ensuring the right information is evaluated. After all, you don’t want to approve a new customer named ABC, Inc. without confirming whether they’re Advanced Business Corporation, Inc. or American Brewing Company, Inc. Investing in optimizing business entity matching—or identity resolution—can help to resolve these mistakes.

A robust business identity matching process is also vital to automated decisioning, as it removes as much of the manual review as possible. Here are four factors that drive the success of a match process:

- Quality and Completeness of the Inquiry Data — all fields should be populated with valid, correct data. Something as simple as form validation can measurably improve the results.

- Quality and Completeness of the Reference Data — unlike consumer data, where a Social Security number easily disambiguates individuals with otherwise similar identity data, matching business entities presents a greater challenge. To increase the chances of a successful match, work with the most complete reference file available. In addition to fields equivalent to those in the inquiry data, alternate values (tradestyle business names, former addresses, etc.) also increase the chances of a successful match.

- Match Process and Algorithm — when the stakes are high, it’s important to use a robust, stable match engine. A referential match system, refined to accommodate spelling and formatting errors, data latency, and other flaws, is designed to consistently return the right record.

- Stewardship Enablement — match metadata can be used to automatically accept or reject matches. Some cases may require manual review and/or submitting business investigations.

Credit Decisioning

Once the applicant’s identity is verified, it’s time to decide whether to approve or decline the credit application. To set the criteria used to make this decision, you can begin with the overall business goals and performance metrics (e.g. risk tolerance, target approval rate). Ideally, aim to minimize losses without compromising growth, so typical metrics include delinquency and write-off rates, revenue, and profit.

The most convenient and expeditious way to inform a credit decision is to use a combination of standard risk scores. In most cases, these standard scorecards are empirically derived using an assortment of potentially predictive data sources—such as trade credit, firmographics, and public records—thus ensuring wide application and sound performance.

More sophisticated users who want to optimize their model performance may use similar variables to build a custom model with expanded data sources and attributes. Such custom origination models can be developed either in-house or via a partner such as Dun & Bradstreet.

Whether using a standard scorecard or custom models, we typically see improved performance by considering several sources:

- Traditional commercial credit data elements, both financial and non-financial payments, tend to be the strongest predictors of delinquencies. These include detailed and aggregated trade payment data and related descriptive indices such as the D&B PAYDEX®, along with predictive scores such as the D&B® Delinquency Score and the D&B® Failure Score.

- The give-to-get repositories of the Small Business Financial Exchange® (SBFE) and Dun & Bradstreet’s own Small Business Risk Insight (SBRI) offer contributors highly predictive line-level and aggregated data on small businesses, where information may be less readily available. SBFE and SBRI scores and attributes are derived using “like credit” data—or data gathered for the same type of obligation (e.g. lines, loans, leases, cards) as the lending decision at hand.

- Less directly related, but also highly predictive, are other basic commercial data elements. This includes firmographics (size, age, line of business, hierarchy structure) as well as public records (bankruptcies, suits, liens, judgments, and UCC filings), which offer insights into other business and financial risks.

- Mitigating fraud risk is also a demonstrated best practice. Although rates of incidence are typically low (a very small portion of credit applications are attempts at fraud), it can be a high-impact event. In such cases, it’s common to lose the entire loan amount or credit limit; thus, fraud losses can be substantial. Incorporating additional due diligence and adopting fraud scores to help prevent onboarding of potentially fraudulent deals can be wise investments, especially during times when automation is increasing and the use of online credit applications is expanding.

- Other organizations are also successfully incorporating novel or innovative data types from alternative sources. For example, rent and utilities usage, credit inquiries, online traffic, physical foot traffic, and many more all offer perspectives into the activity levels, viability, and risk profile of a business. To enable such exploration, Dun & Bradstreet curates a wealth of ever-growing alternative data.

Credit Limit Assignment

Setting the credit limit requires a bit of a balancing act, based on your company’s risk tolerance and appetite for growth, and as importantly, the applicants’ need for credit. In most cases, many of the same data elements that are key in decisioning are also useful in assigning credit limits.

Risk Focus

Starting with the most basic considerations, it’s important to first ensure the applicant can make the required payments, which in most cases are proportionate to the credit limit and balance. Firmographic elements that indicate business scale, such as annual revenues, number of employees, and years in business can be used to cap the credit limit. For larger credit limits, financial statement data is commonly used in combination with current credit balance data to confirm that debt-to-income ratios don’t exceed recommended guidelines.

For a more complete view of future risk, you can also evaluate anticipated usage. Based on industry and size, you can rationalize the need for credit and ensure the limit is in line with that extended to similar companies.

Next, seek to understand wallet share and past and current high credit. One common conservative strategy is to match, but not exceed, the highest historical high credit amount. If payments were made on time, the business has arguably demonstrated its ability to make payments on this scale. A similar reasoning can be applied to non-financial trade credit data, which is generally another excellent predictor of payment behavior.

Growth Focus

If the goal is to favor growth, you can test carefully calculated risks outside the common practices suggested above. For example, you may anticipate that applicants with spotless credit histories and stellar scores (e.g. PAYDEX, Delinquency, Failure) are likely to use their credit wisely, only taking on what they can confidently repay. In such cases, the higher limit may lead to incremental sales.

It may also be informative to consider a business’s historical payment behavior by type and size of obligation. One common observation is that businesses default on credit before they do on financial products. Likewise, many businesses put more effort into paying large balances on time, over smaller, less visible obligations. Together, these trends may justify measured increases in credit limit.

Implementing Automation

Building a more efficient credit decisioning process requires automating as many of the above steps as possible. While 100% automation would be most efficient, you can expect that, in reality, a portion of applications require further review. Still, any automation is an efficiency gain, as it reduces costly manual—or judgmental—intervention.

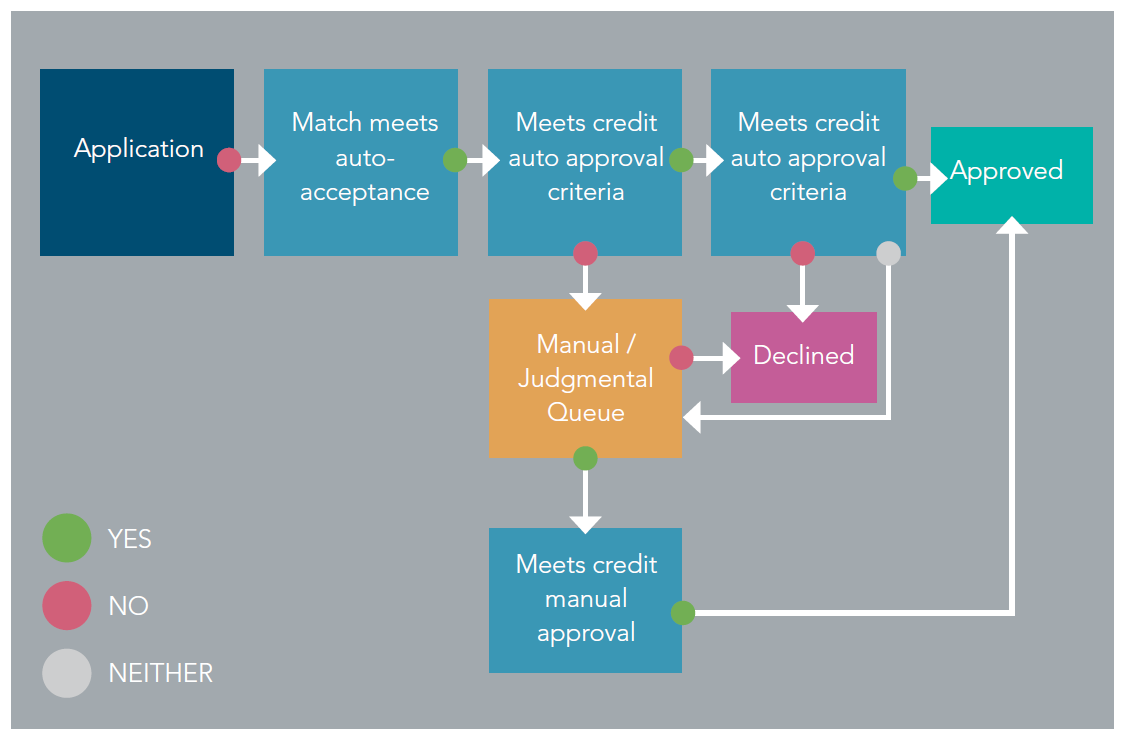

Automated decisioning fails when information is either insufficient or conflicting, requiring manual review. In addition, some credit requests automatically enter the judgmental queue based on higher risk exposure. A final set of applicants destined for a judgmental decision is the “gray area” segment, if their scores are marginal—neither high enough for an auto-approval, nor low enough for an auto-decline. These applicants need human intervention, based on data beyond the score; this may include considering their debt-to-income ratio, special events, or details of a potential past delinquency (if it happened over a year ago or on a small obligation, for example). To this end, the manual review process allows a more nuanced set of variables and factors to be evaluated using several research tools, such as Dun & Bradstreet’s DNBi.

Figure 1 | Credit Decisioning Process

How Dun & Bradstreet Can Help

Enabling automated decisioning requires establishing policies and models that align with business goals and employ the most reliably predictive data. As a leading global provider of business decisioning data and analytics, Dun & Bradstreet can fuel these models with both traditional and new firmographic and credit elements and scores, delivered through modern Application Programming Interface (API) solutions that allow match and data processes to seamlessly flow through your applications.

Alternatively, if you’d prefer to build and refine your own models, consider exploring the data elements available in the D&B Analytics Studio.

If your decisioning process could use a tune-up, we can share best practices for your specific situation. We can develop origination models on your behalf, based on your own applicant pool and portfolios using reject inference and performance with other lenders to learn and adjust your models and strategy.

The information provided is suggestion only and based on best practices. Nothing stated or implied in such information should be construed to be legal, tax, or professional advice. Dun & Bradstreet is not liable for the outcome or results of the use or reliance on the information provided. Please contact an attorney or tax professional if you are in need of legal or tax advice.