Greater Data Access, Advanced Analytics and Risk Decisioning Will Be Key to the Success of Credit Insurers After COVID-19

The use of technology has made a significant impact in the world of credit management and like in other industries, the pandemic has highlighted the fragility of existing operating models and how technology investment adds robustness. Organisations are experiencing major disruption and CFOs are evaluating a wide range of scenarios that cover the impacts of the pandemic, in fact, 71% of CFOs are concerned about the financial impact of COVID-19(1).

With this crisis setting a new benchmark standard for the “unknowable”, many CFOs are considering digitisation and automation to enhance productivity and reduce costs.

The companies that will lead in post COVID-19 are those that will use the impact of the pandemic as the catalyst to take action to embrace digital experiences, truly understand their customers, utilise automation, and future proof their operating models by investing in data and digital technologies.

There are three main technology areas that will be key to businesses in a post-pandemic world that the Credit Management industry must be aware of:

- Greater data access but with tighter controls

- Advanced analytics powering better risk decisioning

- Increased automation using modern technology to drive business efficiency

Greater access to data

In today’s world there has never been so much data available nor access to it.

The UK Government is committed to open data, highlighted by the UK

Small Business, Enterprise and Employment (SBEE) Act (2015) which is focused on improving access to finance for small businesses (SMEs). The Act states that banks must provide designated Credit Reference Agencies (CRAs) with their SME commercial data including current account, credit card and loans data.

At the same time, HMRC is providing access to the UK VAT register, but only for those CRAs who have the required security protocols in place, including ISO27001 Information Security Accreditation as a mandatory requirement.

However, in recent years some of Companies House filing requirements have changed, meaning fewer businesses have to file detailed annual accounts (BS, P&L, Cashflow). Consequently, this can have an impact on the effectiveness of certain risk scorecards and underwriting models.

Nevertheless, the Corporate Transparency and Register Reform Consultation gives Companies House greater powers to inspect and reject incomplete, inaccurate or suspicious filings and to compare data with HMRC and other Government Agencies – powers they have never had before. The Consultation also proposes the validation of director and shareholder submissions including identity checks of all individuals involved with the business and better knowledge of Ultimate Beneficial Owners.

Dun & Bradstreet has helped to shape access regulation globally. Dun & Bradstreet is a founding member and was the founding Chair of BIPA, the Business Information Providers Association, comprising of seven leading Commercial Credit Reference Agencies in the UK. BIPA has been instrumental in working with the Government to release VAT Registration Data to qualifying parties, and for seeking improved access to better data, especially for SMEs where current data is sparse and access to credit is more difficult.

Dun & Bradstreet is also a Board Member of FEBIS – Federation of Business Information Services –. Its well-established Regulatory Committee responds to Consultation and Discussion papers from the EU and other jurisdictions, and regularly attends workshops, think tanks and webinars with the EU and its appointed agents.

Advanced Analytics

The practical application of Machine Learning and Artificial Intelligence for commercial risk purposes is in its relative infancy and there has been a greater adoption of regression based and other decisioning models for more consistent risk decisioning.

Many organisations are now looking for not just speed in decision-making but also for platforms to deliver data and scores that can give quicker on-boarding decisions. Many of the newer challenger banks are looking for a “standard deviation” of rapid acceptance to allow 90-95% of new applications to be processed in real time. Organisations are increasingly moving away from high levels of manual referrals in order to save cost, accelerate the acceptance/rejection process and grow their business.

Credit Risk Models have traditionally been built on historical trends. This year has demonstrated that this no longer holds true. As a result, analytics need to evolve to deliver more reactive and dynamic assessments of future risk, based on more relevant and timely data triggers, signals and insights.

Data providers are seeing a constant exponential expansion of available data, but the challenge relays on understanding these high volumes of data to identify what is important, relevant and then translate it into actionable insight. For example, years of detailed transactional data on a company’s bank account are now available to Dun & Bradstreet, but this needs to be condensed into useful insights to truly quantify whether the actual working capital of that business has changed as a result of COVID-19 and what that actually means for their risk profile.

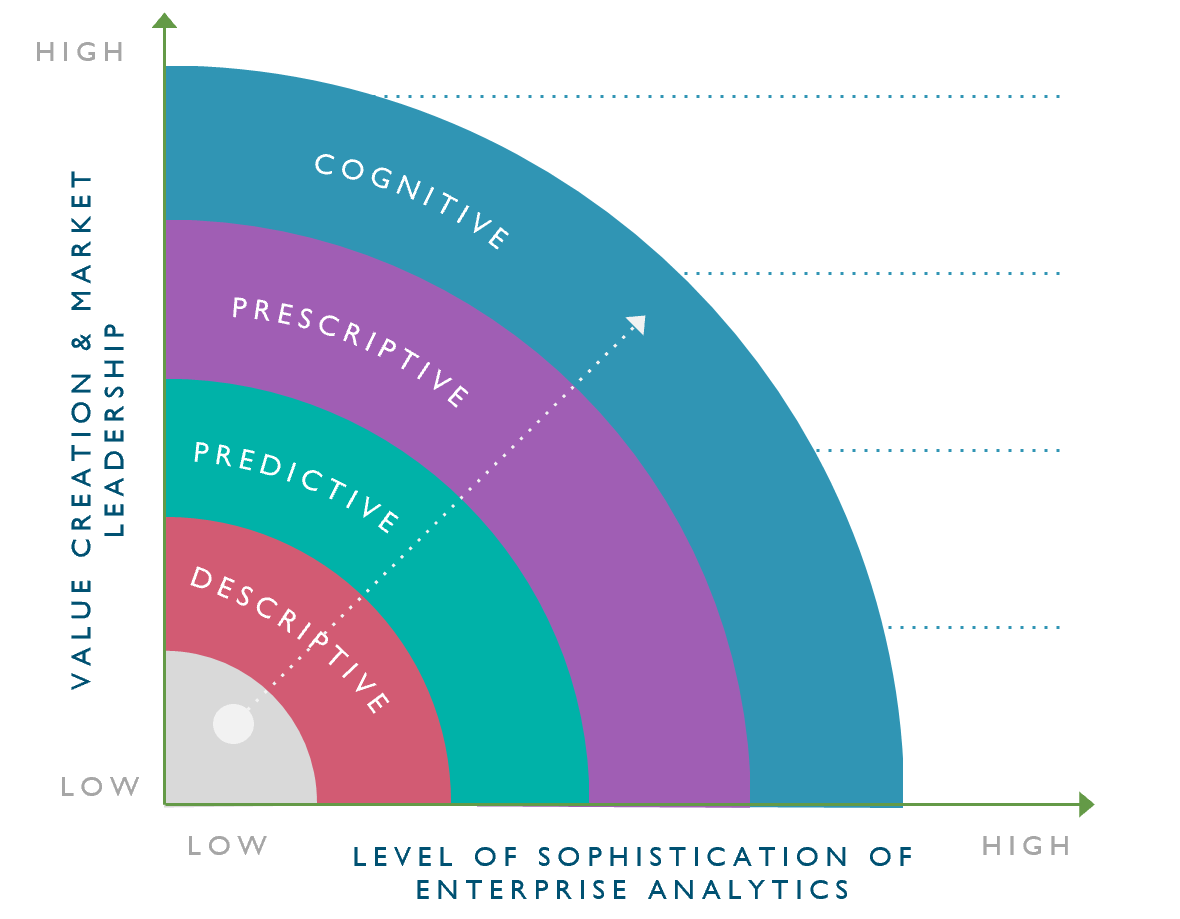

In a recent study by Harvard Business Review, “Why Your Data Strategy Is Your B2B Growth Strategy”, four types of businesses were identified with respect to their data analytics usage:

- Descriptive Analytics: 68% of companies obtain hindsight on what has happened and why it has happened.

- Predictive Analytics: 16% of companies glean insight on what will happen.

- Prescriptive Analytics: 11% of companies lean on analytics outcomes to determine next best steps to accelerate revenue and reduce risk.

- Cognitive Analytics: 5% of companies employ Machine Learning and other forms of AI to continually improve and adjust for rapid change.

Dun & Bradstreet helps businesses evolve into advanced analytics enterprises:

Despite this increase in volume, it is still important to recognise the value of traditional data insights. Foundational characteristics of a commercial risk such as a strong balance sheet, sensible cash flow management, experienced management team, robust risk policies and governance are still critical in risk assessment. This traditional assessment then needs to be combined and enriched with dynamic and up-to-date data insights to deliver a high-resolution view of the risk.

Dun & Bradstreet has adapted to these changing unprecedented conditions by developing complimentary models for its clients which use relevant and dynamic data inputs to specifically produce COVID-19 impact assessments which are fluid and updated in real-time as the situation changes. These not only consider the impact of the pandemic on an individual business but also its associated customer/supplier trading network. This adds an innovative dimension to Dun & Bradstreet’s traditional credit assessment of a business and illustrates how models will evolve in the future to be more adaptable.

Risk assessments should not just be an annual exercise at onboarding or renewal – daily monitoring is vitally important to regularly assess risk exposure at a portfolio, sector or regional level. It forewarns of impending changes in a company’s risk profile and offers the opportunity to take remedial action quickly.

Automation

Adoption of modern software into technology stacks has increased significantly across industries. Businesses are gradually looking for automation, integration and consolidation to improve decisioning and creating single views of data which is held disparately in multiple silos.

Businesses have moved from home-grown technology to heavyweight ERP infrastructure to lighter, more flexible software. Businesses have also increased their adoption of CRM software into the finance and credit management processes like adding credit risk decisioning via Salesforce Data Cloud.

Plug & play connectors are also set to bring third party data and analytics to life within third party software, thereby avoiding a complex IT project. The advantages of this type of integration and automation can be large and often give benefit quickly. Credit risk processes being available in systems where the customers and/or salespeople reside, brings a consistency of decisioning and immediacy of response to exactly where the information is needed. With tuned referral processes for the more complex of marginal decisions, downstream workflow processes for full credit decisions – potentially in concern with insurance underwriters.

Well-designed automated systems also allow for decisions and workflow outcomes to be adjusted centrally when necessary. This may be where a desired portfolio or sector risk level is deemed too high and stricter decisions need to be made – potentially with immediate effect on all relevant cases.

Automation also brings a level of accuracy to data and decisioning that manual processes often miss. Well maintained master data ensures that decisions are made on the correct entities, utilizing the correct data that is available.

The ability to quickly and accurately identify risk and then pre-populate independently validated and reliable risk characteristics is as important to the commercial insurance industry as has already been adopted for consumer lines. Technology and automation will help to reduce the multiple and unnecessary repetition of entering the same data over and over for the same risk between quote inception and policy bind.

Gartner predicts (2) hyper-automation, AI and more will dominate business technology in 2021. Hyperautomation is a process in which businesses automate as many business and IT processes as possible using tools like AI, machine learning, event-driven software, robotic process automation, and other types of decision process and task automation tools.

COVID-19 has rapidly increased the need to automate repetitive, manual tasks to help free up teams to focus on more business-critical tasks and this is no different for the credit risk function. Dun & Bradstreet can help you in automating the on-boarding process and getting an instant decision saving time spent with businesses that won’t meet your policy thresholds.

(1) PWC.com “PwC’s COVID-19 CFO Pulse Survey”