The following article was originally written for Lattice Engines which was acquired by Dun & Bradstreet in 2019. Learn more about D&B Lattice, our market-leading Customer Data Platform.

Its conference season again for B2B Marketers and as we head into the “Superbowl of B2B Marketing Conferences” (SiriusDecisions Summit), I’ve been reflecting on some recent trends related to the Customer Data Platform (CDP) market.

- Adobe, Salesforce and Oracle, have all made announcements that they are bringing their own CDPs to market.

- Gartner released a Market Guide for Customer Data Platforms late last year.

- Forrester Research published “The Forrester New Wave™ for B2B Customer Data Platforms” and named D&B Lattice a Leader

- According to the CDP Institute, total revenue for the market is estimated to top $1B (gated link).

- There is also now a vendor-neutral certification that lists out criteria vendors need to meet in order to classify as a Customer Data Platform (more on that below).

- Learn what Forrester Research says you should look for in a B2B CDP and why D&B Lattice leads the pack.

Without a doubt, the Customer Data Platform (CDP) market is real and here to stay.

As is often the case, however, along with the buzz comes confusion. I want to unpack what exactly a Customer Data Platform can do for B2B marketers and how to cut through the hype when evaluating CDP vendors.

What can a B2B Customer Data Platform do for you?

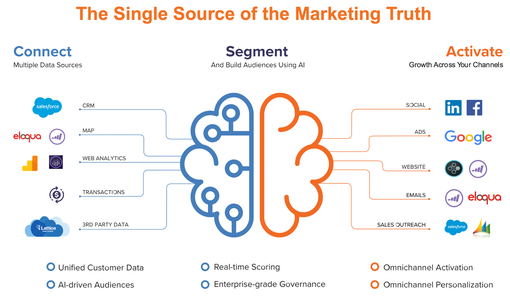

The promise of a Customer Data Platform is simple yet enormous. It is the single source of marketing truth - allowing you to simplify your data, centralize your segmentation and audience creation, and deliver successful 1:1 omni channel campaigns.

There are three steps to how a CDP enables you to do this:

- Ingest all customer and prospect data from all your marketing and sales systems (marketing automation, CRM, web analytics), enterprise systems (ERP, transaction, product usage, support calls, etc.), third party sources (e.g. DnB, etc.)

- Unify the data and create campaign audiences using this data

- Activate those audiences in 1:1 campaigns across all your channels

In a world where B2B brands are looking to engage customers in a more meaningful way across the entire buying journey, this value proposition could not be more tantalizing. Companies like Google, Informatica, Tibco, US Foods, and the like have used a Customer Data Platform to achieve 65% higher engagement, 3x greater pipeline and 3%-5% greater sales quota attainment.

But, how do you find the right CDP vendor for your needs?

What to look for in a B2B Customer Data Platform?

As it turns out not all CDPs are created equal. As mentioned above, David Raab and CDP Institute just recently released the RealCDP certification which serves as a “Good Housekeeping Seal” for CDP vendors. It does a good job of listing the evaluation criteria for CDP vendors.

- Ingest data from any source - pretty self explanatory

- Capture full detail of ingested data - capture all the raw data (e.g. each website visit, click stream, etc.)

- Store data indefinitely (subject to privacy constraints) - pretty self-explanatory

- Create unified profiles of identified individuals - identify and match data for each individual across all your source systems to create a “360-degree” view

- Share data with any system that needs it - share the raw data sets based on segmentation criteria with downstream systems

Five Additional Evaluation Criteria for B2B Customer Data Platforms

Turns out, though, the RealCDP criteria misses out on some key needs for B2B marketing and sales.

- Mapping leads to buying groups, accounts and account hierarchies - in B2B, you’re selling to individuals in buying centers and accounts (which live in account hierarchies) - so to match up data across your source systems to build the unified profiles, you need to identify not just individuals, but the buying group(s) to which they belong, accounts and the place within the account hierarchy in which they belong.

- Deep integration with the Sales channel - in B2B, the sales channel is critical. In order for marketing to be successful, sales needs to adopt the leads and recommendations sent over from marketing. As such, the integration with sales tools must have capabilities designed to drive sales adoption [e.g. rather than just “sharing data”]

- Open and Flexible AI - marketers crave agility - and AI provides the sifting and automation needed to identify key insights you need for creating the right segments and prioritizing audiences. You need the ability to create models for different types of predictions (e.g. likelihood to convert a net new customer, expected spend, likelihood to buy more, likelihood to churn, etc.). Many times, companies will have Data Science teams that create these models so you need to ensure the CDP can import and leverage those models.

- Third Party Data Integration - marketers use many third party data sources segmentation and targeting - e.g. firmographics, tech install data, public intent and keyword search data, market share data, etc. Often, this data comes pre-integrated with the CDP (so as to reduce the overhead needed to manage multiple third party data contracts). But, the CDP must be able to easily ingest any non-1st party source and incorporate that data into the unified profiles.

- Platform Independence - given that 82% of B2B marketers use a best of breed strategy when it comes to the martech stack, its critical that vendors are not tied to a specific platform or Marketing/Sales Cloud.

In conclusion, the CDP market is real and here to stay. The benefits for B2B marketers are substantial I think the RealCDP announcement is an absolute positive for a market that’s coming into its own. However, there are some additional criteria missing that B2B marketers should look at when evaluating CDP vendors. Frankly, I’m not sure some of the offerings announced by the larger cloud vendors really meet the criteria - but I’ll leave that for my next post.

We are continuing to work with independent experts like the CDP Institute to ensure that the certification captures all the relevant criteria so that it is a reliable way for marketers to separate the CDP wheat from the CDP chaff.