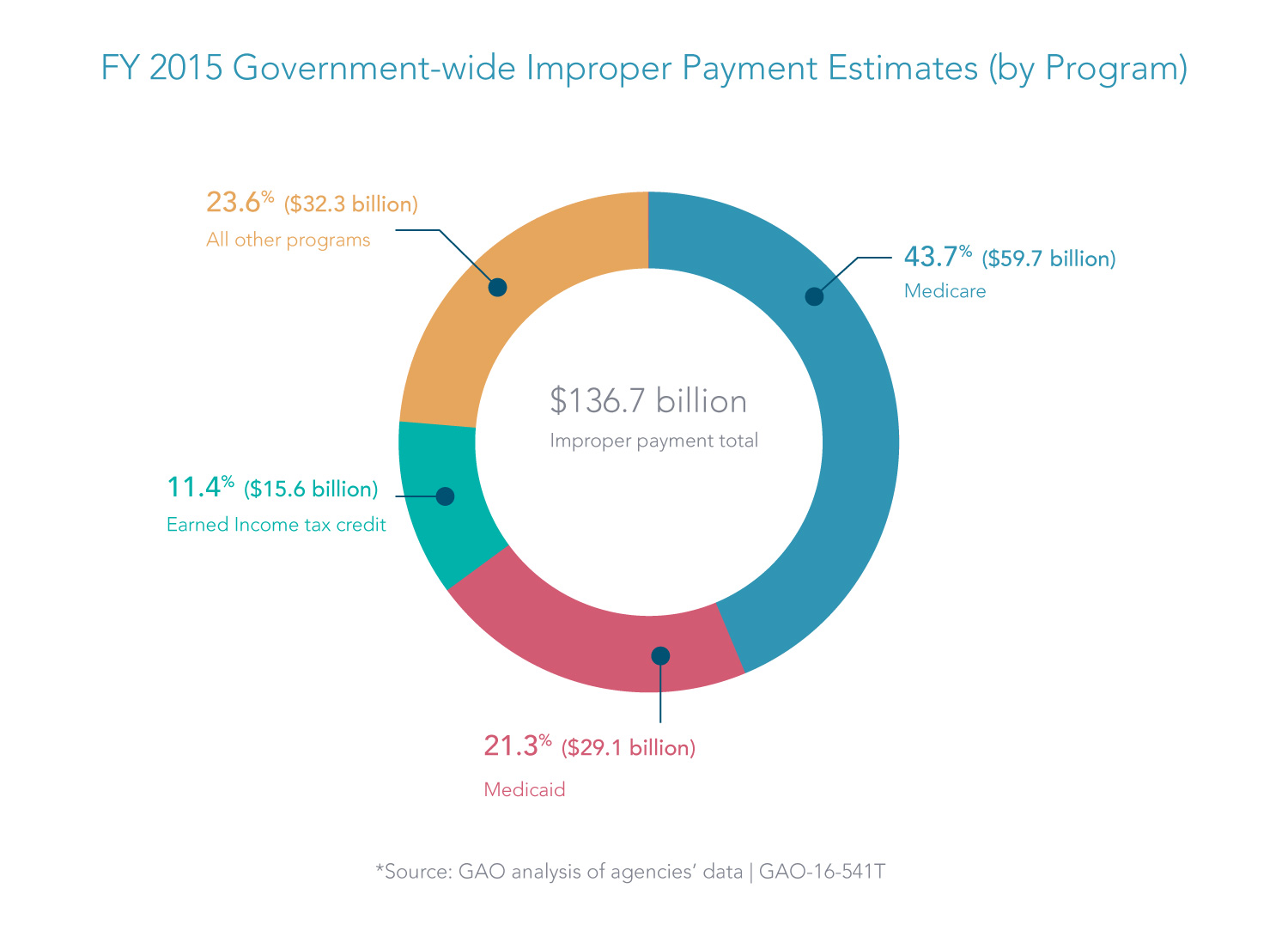

Our last article highlighted a renewed urgency by officials at the U.S. Office of Management and Budget (OMB) to reduce improper payments, which soared to $136.7 billion among federal agencies in fiscal year 2015.

Two major programs—Medicare and Medicaid—accounted for 65 percent these improper payments, according to the Government Accountability Office (GAO). Improper payments in Medicare and Medicaid programs totaled $88.8 billion. A good portion of that was due to fraud.

There are two complementary methods for fighting fraud. The first calls for rigorous controls to screen providers and prevent the payment of funds to ineligible or fraudulent entities. The second calls for aggressively investigating and prosecuting those who, despite the controls, illegally obtain government funds. Both approaches are essential, but the first—putting in place rigorous controls that prevent improper payments—ultimately saves significantly more money in the long run.

Preventing Fraud Before It Happens

The Centers for Medicare and Medicaid Services (CMS) are making great strides in identifying fraud before payments go out the door, particularly with the Fraud Prevention System (FPS), which uses predictive analytics to identify claims and providers that present a high fraud risk to the Medicare program.

In July 2016, CMS reported that the FPS stopped, prevented, or identified $450 million in improper payments in 2014, resulting in nearly $10 of savings for every dollar invested.1 In addition, CMS took administrative action against 1,093 providers and suppliers due to the FPS.

In delivering healthcare benefits and services, state governments, as partners with the federal government, are also looking to reduce provider fraud. Even with the success of FPS, healthcare providers receive tens of billions of dollars annually in improper payments. How can federal and state agencies strengthen their capabilities to counter fraud and other risks?

Triangulating Information with Third-Party Data

Federal and state agencies that reimburse healthcare providers can significantly enhance their risk modeling and fraud detection with third-party data that provides greater transparency into the executives, organizational structure, operations and risks posed by healthcare providers.

In most cases, an agency's insight into a provider derives primarily from information gathered during its interactions with the provider, such as through initial registration or claims submissions. However, these interactions provide only a narrow window into a provider's activities. By enriching their data with third-party data and analytics, agencies can dramatically expand that window to gain visibility into the provider's interactions with the rest of the world.

What might agencies see with this global view of providers? For example, a provider may submit tens of millions of dollars in claims annually without any apparent signs of fraud in its interactions with the responsible agency. In contrast, the provider's business interactions beyond the agency's purview might contain telling signs of risk. The data might reveal that the provider has:

- Little or no payment record showing that it has purchased the kinds of services, utilities, or supplies typical of other providers with its volume of claims.

- Corporate executives linked to other fraudulent providers.

- Increased debt, delinquency and provider failure risk.

- Litigation and Tax Liens.

"Agencies can triangulate information among these many different perspectives or data points to obtain a more transparent view of a provider," said Sandy Wright, Director of Government Business Development at Dun & Bradstreet. "A provider may look just the opposite of what you might expect if it were truly a legitimate and thriving business, thus raising red flags requiring further scrutiny."

Gaining Insight through Claims Data and Predictive Analytics

As agencies start building risk models that combine external data with their own data, they can also incorporate their claims data to enhance the predictive power of their models.

"There's a lot of valuable historical detail in the medical claims—such as the number of claims or amounts charged—that can be combined with other provider data to spot anomalies," Wright said. "By drawing from a broad set of customized data points, agencies can take advantage of predictive analytics to create more powerful risk models that allow them to prioritize fraud investigations more effectively."

Continued Prosecution: Federal Department Ramps Up Prosecutions

The other piece to combating fraud is the aggressive prosecution of criminals. The Department of Health and Human Services (HHS), along with its partners in law enforcement and the states, have been unrelenting in this regard.

In October 2016 alone, HHS announced more than 30 new criminal and civil enforcement actions against doctors, hospitals, and other providers of healthcare services for perpetrating fraud schemes against Medicare and Medicaid programs.2 In one case, a hospital chain was required to pay over $513 million for making illegal payments in exchange for patient referrals in Medicare and Medicaid programs.3

The latter case was brought as part of the Health Care Fraud Prevention and Enforcement Action Team (HEAT) initiative, a seven-year partnership between HHS and the Department of Justice (DOJ). Since January 2009, DOJ has recovered more than $30.9 billion through False Claims Act cases. More than $18.6 billion of that amount involved fraud against federal healthcare programs.

Reducing 'Pay and Chase'

We applaud the government's highly successful efforts to prosecute criminals who defraud the Medicare and Medicaid programs. Programs such as HEAT help to recover billions of taxpayer dollars of while also sending a strong message to deter future criminal activity.

But capabilities now exist for strong predictive analytics that can reduce "pay and chase" by preventing fraud before it even occurs. Ultimately, prevention is more efficient than prosecution. And the return on investment for fraud prevention measures, as shown in the FPS and other programs, is extremely high. Together, predictive analytics and aggressive prosecution can help agencies reduce risk and improve decision making to ensure that healthcare funds achieve their intended results.

1 CMS, "Annual Report to Congress on the Medicare and Medicaid Integrity Programs," p. 35, released July 20, 2016.

2 See https://oig.hhs.gov/fraud/enforcement/criminal/

3 Department of Justice press release, "Hospital Chain Will Pay over $513 Million for Defrauding the United States and Making Illegal Payments in Exchange for Patient Referrals; Two Subsidiaries Agree to Plead Guilty," October 3, 2016. https://www.justice.gov/opa/pr/hospital-chain-will-pay-over-513-million-defrauding-united-states-and-making-illegal-payments