Stimulus bills and government programs will forever be a sign of the times for the global pandemic that started in 2020 and, undoubtedly, touched everyone’s lives in one way or another. Whether it was changing your daily routine to include wearing a mask or the stark and quick realization as a business owner that consumer spending sharply declined, each of us has incurred some level of stress and uncertainty from COVID-19. This situation and its impact are unprecedented for most because this level of global health crisis has not taken place since the flu pandemic in 1918.

During the coronavirus pandemic, several niche products and innovations were created out of necessity and those business innovators have been able to thrive during the downturn. However, many small businesses that communities rely on were faced with mandates that prevented them from operating, and “business as usual” was no longer a given.

If your business was negatively impacted in 2020, or you chose to start a new venture in 2019 and were just getting on your feet before the pandemic, remind yourself that before COVID-19, the economic climate was experiencing significant growth. 69% of businesses were expecting 2020 to bring revenue increases and the extent of the aftermath of the pandemic was unpredictable.

However, it is a good idea to examine what happened and what we can learn from it.

Fortunately, experts have reported that even though this recession felt as devastating as the great depression of 1929, and, in some ways, has cut deeper than the recession of 2008, it is not projected to turn into a depression. In addition, economists think the longevity of this economic downturn is expected to be shorter, because it originated from the pandemic and not from an artificial inflation in the housing market. For more on the economic crisis, there are several published reports that may be worth researching for a deeper understanding.

Recovery may be the word that defines 2021 for many businesses. And, for businesses that were able to secure government funding or have discovered innovative efficiencies that prevented any major financial loss, safeguarding and developing a solid foundation will be key steps to take as the forecast of a slow rebound and even some smaller retractions lie ahead.

The Quick-Drop of 2020

Beginning in the first quarter of 2020, the economy contracted by 5% as a result of government-mandated stay-at-home orders, public facility closures, and business shutdowns – all designed to slow the spread of COVID-19. The economic decline ended the longest economic expansion in history.

By the second quarter, with a record contraction of 31%, business owners likely felt an impact either from an order to close doors for business, a drop in sales, or being forced to lay off or furlough employees.

By the end of March, the CARES Act was signed providing emergency relief resources for small businesses and by April, the Paycheck Protection Program and Health Care Enhancement Act allocated $483.4 billion for small businesses, hospitals and testing.

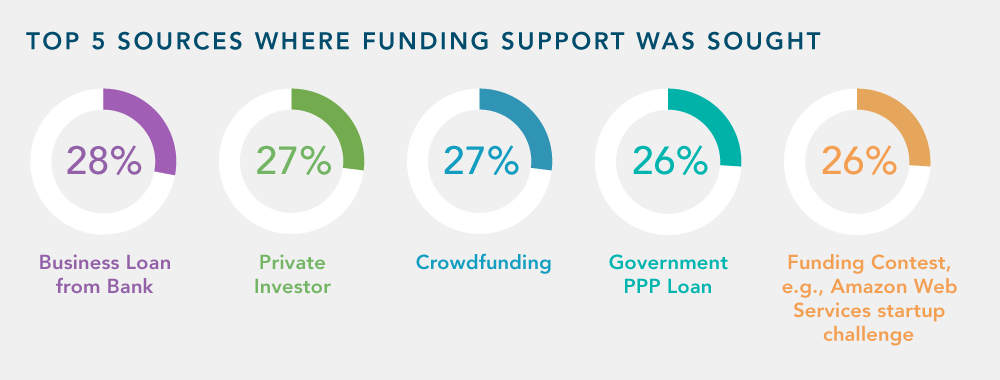

Small businesses started to seek financial assistance from government programs or their own savings. In fact, 59% of small businesses who responded to our small business survey, stated they depended on at least one source of external funding, other than business revenue, during the pandemic.

Unfortunately, many faced the inability to secure funding, discovering they were not creditworthy, could not provide proof of strong cash flow, etc. As a last resort, they turned to their personal savings or friends and families.

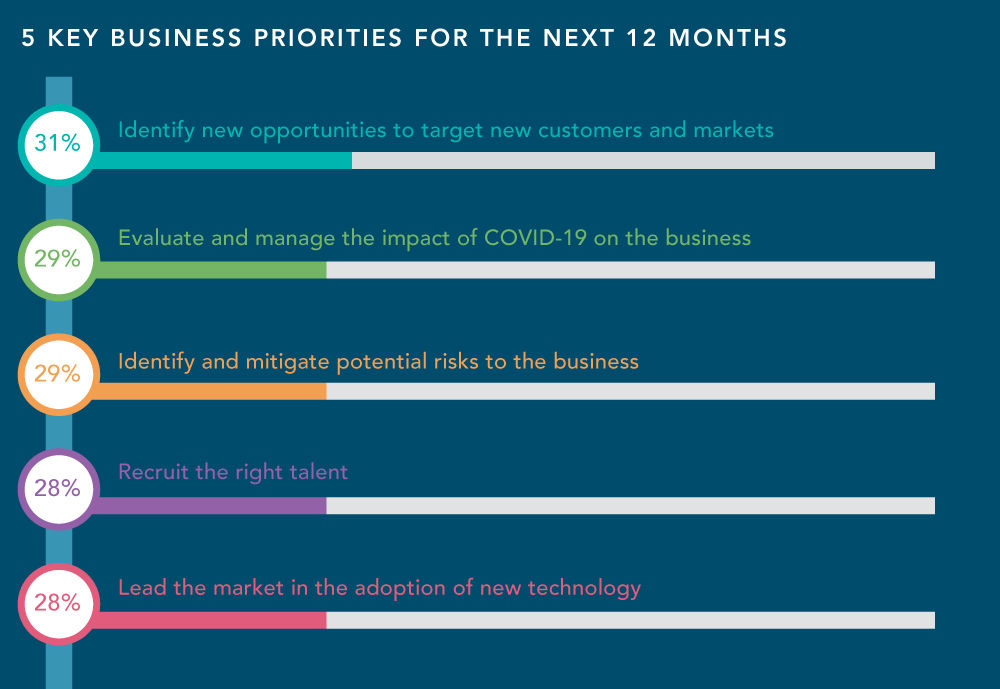

COVID-19 has prompted owners to become even more serious about implementing measures to safeguard and prepare. It provided an opportunity to learn that beyond having growth plans, a small business owner must plan for unexpected challenges. Those that learned they were facing business credit challenges, or through no fault of their own, have taken a hit to their credit because of the pandemic, may want to consider working on their business credit file as a key priority. Our respondents shared their five key priorities for 2021. Managing the impact of COVID-19 on their business is one of the top five, which are listed follows:

The Slow Ascension - Government Funding, Establishing and Using Business Credit

Cautiously, experts are stating that the U.S. economy is improving, despite some businesses still being in distress due to restrictions and ongoing liabilities to their employees and financial institutions.

The forecast released on December 16, 2020 stated that U.S. GDP growth was expected to contract by 2.4% in 2020, however, it is estimated to then rebound up to 4.2% growth in 2021.

Being poised as a small business to cover expenses, engage in new partnerships, or even expand during this time, could be made much easier with an established business credit file.

A business credit file can start when a small business owner registers their business, or establishes a Data Universal Numbering System (D-U-N-S®) Number with Dun & Bradstreet through the Get a D-U-N-S registration system which is a simple and free process.

A business credit file may help determine creditworthiness and can also be viewed by federal and local authorities when selecting companies for government contracts, or by other companies looking for partnerships. One of the most commonly used business credit scores is the Dun & Bradstreet PAYDEX® score.

If you already have a D-U-N-S Number and you are ready to take steps to help potentially impact your scores and ratings, consider using CreditBuilder Plus to submit payment experiences* to Dun & Bradstreet for its verification and acceptance.

Here are some other tips that may help small business owners as they look to mitigate risks and recover from the impact COVID-19 had on their business.

Tip #1: Find New Customers For New Opportunities Using Reliable Data

Amid all this change, according to our respondents, is the need to identify new opportunities and to target new customers and markets. It’s not surprising that small business owners and entrepreneurs, are looking for new ways to evolve. When considering a new opportunity and targeting new customers, it is important to focus on an appropriate target audience, and to do so, ensuring that any data used to target new audiences is as reliable as possible. In addition, consider the message you are sending to your new customers. Your target audience will want to receive offers that matter to their needs, and may feel more confident doing business with you, if your contact information is up-to-date. If you opt to invest in a leads list, selecting a partner that provides clean and up-to-date data is the first step in getting a list that is appropriate.

List services often focus on catering to large businesses – or their lists are too outdated to be useful. Dun & Bradstreet offers list services tailored for small businesses, and D&B Hoovers™ offers dynamic search and list-building capabilities with real-time trigger alerts and comprehensive company profiles to help you with better targeting. All of this translates into you being able to gain access to more intelligent insights for your conversations and relationship building.

Tip #3: Maintain Good Business Credit Before You Need To Request Funding

The pandemic minimized operating hours and occupancy, which drastically reduced cash flow, catching many small business owners off-guard. To help avoid a surprise, it is a good idea to plan ahead as much as possible. One step that can help is creating a business credit file as soon as possible; even if it is simply to make sure that your company is prepared in case of another emergency. Many of our study respondents stated they were turned down for funding due to a poor personal credit rating, or the inability to demonstrate a strong cash flow, among other reasons. One of the keys to helping your business’s ability to survive a crisis – or to grow when opportunity presents itself – can be creating a business credit file and maintaining creditworthiness. This all starts with getting a D-U-N-S® Number and establishing your business credit file with Dun & Bradstreet. Dun & Bradstreet and the D-U-N-S Number are recognized and respected worldwide. In fact, 90% of Fortune 500 companies use our data.

Tip #4: Know Before You Sign – Mitigating Risk: Why Checking a Potential Partner’s Business Credit File Is Important

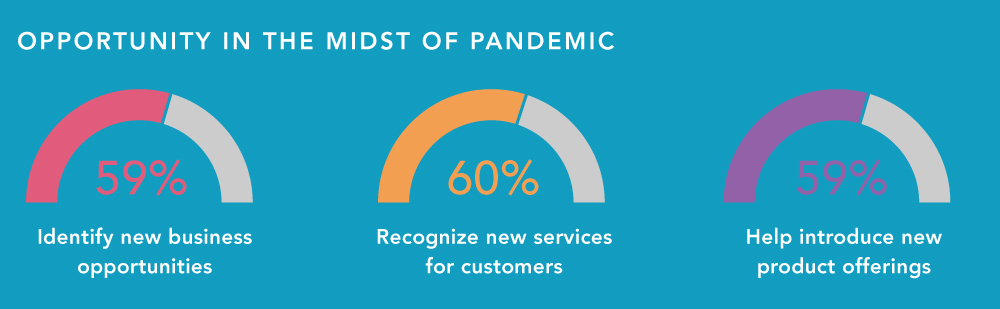

There were, of course, several businesses able to find alternative ways of doing business, in fact 60% of those who responded to our small business survey stated they either created new product offerings, developed new services or found new opportunities.

In order to grow, often small business owners rely on new business partners, suppliers, and vendors. Understanding more about a potential business partner’s business credit and equipping yourself with tools that provide guidance on setting credit limits for new customers based on their company’s payment history are just two types of insights that could help mitigate potential risk for your business as you look to expand and grow. Dun & Bradstreet proprietary tools such as Business Information Report™ and Credit Evaluator Plus™ are designed to give small-business owners the information they need to help make more informed decisions before they extend credit or agree to do business with a new partner, vendor, or supplier.

Whether you found yourself developing a new solution, in search of external funding, or both, very few businesses went unscathed from all that transpired in 2020. Looking ahead, one clear lesson learned is to plan ahead. Consider taking steps to develop a strong business credit file not only for your growth plans, but also in preparation for unexpected downturns. Dun & Bradstreet tools can help. For more information and to compare products, visit our product comparison page.

* Trade References will be added subject to Dun & Bradstreet verification and acceptance. Dun & Bradstreet cannot guarantee that trade references will be accepted or that accepted trade references will impact your business credit file. Please see https://www.dandb.com/glossary/trade-references/ for eligibility, process and other information regarding Trade References.

The information provided in articles are suggestions only and based on best practices. Dun & Bradstreet is not liable for the outcome or results of specific programs or tactics. Please contact an attorney or tax professional if you are in need of legal or tax advice.